TIA Daily COVID-19 Update: April 10th

As TIA continues to monitor the situation surrounding COVID-19 and it’s impact on the 3PL and transportation industries, here is your Daily Update for April 10. As a reminder, you can find all the latest information, resources, guidance, and news from TIA’s COVID-19 Response Center.

Make sure your employees receive critical industry news and updates – such as these Daily Updates – to keep your company healthy in these challenging times. Please contact [email protected] with a list of employees in your company to ensure that everyone benefits from their TIA Membership and has immediate access to crucial TIA resources. You may also log in to the website at www.tianet.org to update your staff listing.

FEDERAL UPDATE:

The Federal Reserve announced new plans yesterday to pump an additional $2.3 trillion of stimulus into a U.S. economy that has been ravaged by the ongoing coronavirus outbreak. The new Fed action will commit to hundreds of billions of dollars in loans to mid-size businesses and the purchase of short-term notes directly from states and large counties. The program details are the following:

1. Bolster the effectiveness of the Small Business Administration’s Paycheck Protection Program (PPP) by supplying liquidity to participating financial institutions through term financing backed by PPP loans to small businesses. The PPP provides loans to small businesses so that they can keep their workers on the payroll. The Paycheck Protection Program Liquidity Facility (PPPLF) will extend credit to eligible financial institutions that originate PPP loans, taking the loans as collateral at face value.

2. Ensure credit flows to small and mid-sized businesses with the purchase of up to $600 billion in loans through the Main Street Lending Program. The Department of the Treasury, using funding from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) will provide $75 billion in equity to the facility.

3. Increase the flow of credit to households and businesses through capital markets, by expanding the size and scope of the Primary and Secondary Market Corporate Credit Facilities (PMCCF and SMCCF) as well as the Term Asset-Backed Securities Loan Facility (TALF). These three programs will now support up to $850 billion in credit backed by $85 billion in credit protection provided by the Treasury.

4. Help state and local governments manage cash flow stresses caused by the coronavirus pandemic by establishing a Municipal Liquidity Facility that will offer up to $500 billion in lending to states and municipalities. The Treasury will provide $35 billion of credit protection to the Federal Reserve for the Municipal Liquidity Facility using funds appropriated by the CARES Act.

5. The Main Street Lending Program will enhance support for small and medium-size business that were in financial good standing before the Coronavirus pandemic by offering 4-year loans to companies with up to 1000 employees with revenue less the 2.5 million (compared to the SBA PPP loans which were designated for companies with 500 employees or less). These loans will have payments deferred for 6 months.

6. The Main Street loans would be a minimum of $1 million and a maximum of either $25 million or an amount that “when added to the Eligible Borrower’s existing outstanding and committed but undrawn debt, does not exceed four times the Eligible Borrower’s 2019 earnings before interest, taxes, depreciation, and amortization,” whatever is less, the Fed said.

7. The Fed will purchase up to $600 billion in loans, with terms seeing an interest rate equal to the Fed’s Secure Overnight Financing Rate, currently 0.01%, plus 250-400 basis points with a four-year maturity.

GOVERNMENT AFFAIRS UPDATE:

Neil Bradley from the U.S Chamber of Commerce just reported on the weekly Small Business Town Hall, that over 250,000 small businesses have applied for the PPP loans. The U.S. Senate was unable to move forward with the unanimous consent request yesterday that would have put another $250 billion in the pot for these loans. Senate Democrats blocked because they want money for hospitals and states as well. With independent contractors being able to apply today, this money will be gone quickly, unless Congress acts.

Please be advised that the very popular Paycheck Protection Program (PPP) loan will become active online today for individuals who file Form 1099s annually. These independent contractors should be filling out the same application as companies; at the top of the application, you will see a box for independent contractors.

TIA UPDATE:

The industry’s favorite two prognosticators (Noël Perry & Donald Broughton) have teamed up and are now producing a more in-depth look at the COVID-19 crisis and its economic impact.

NOËL PERRY UPDATE:

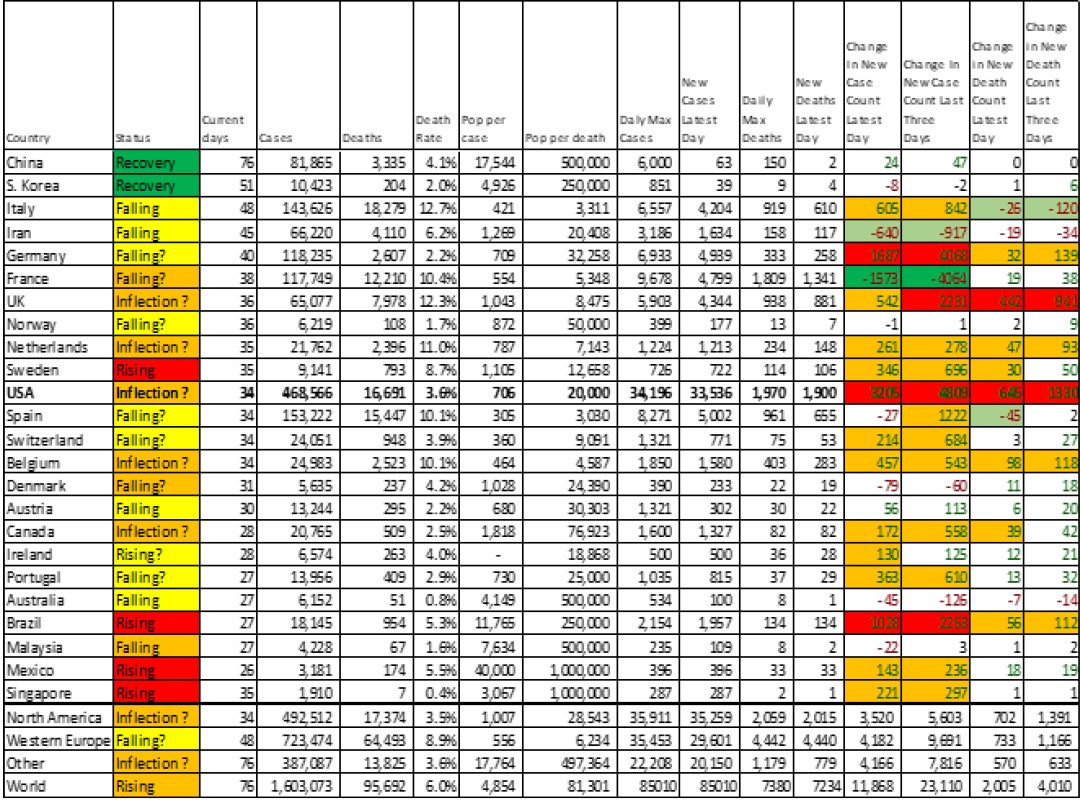

Thursday exhibited its usual move to a weekly max in cases, especially in Western Europe. Documentation practice has created weekend lulls and mid-week maximums in the reporting of new cases. The U.S. was up modestly, although still below last Saturday’s peak. Our numbers continue to be influenced by the expansion of testing.

American medical staff have now tested 2.2 million people, almost twice as much as the next nearest country, Germany. Importantly, U.S. deaths were down for the second straight day, suggesting an inflection in that critical data set.

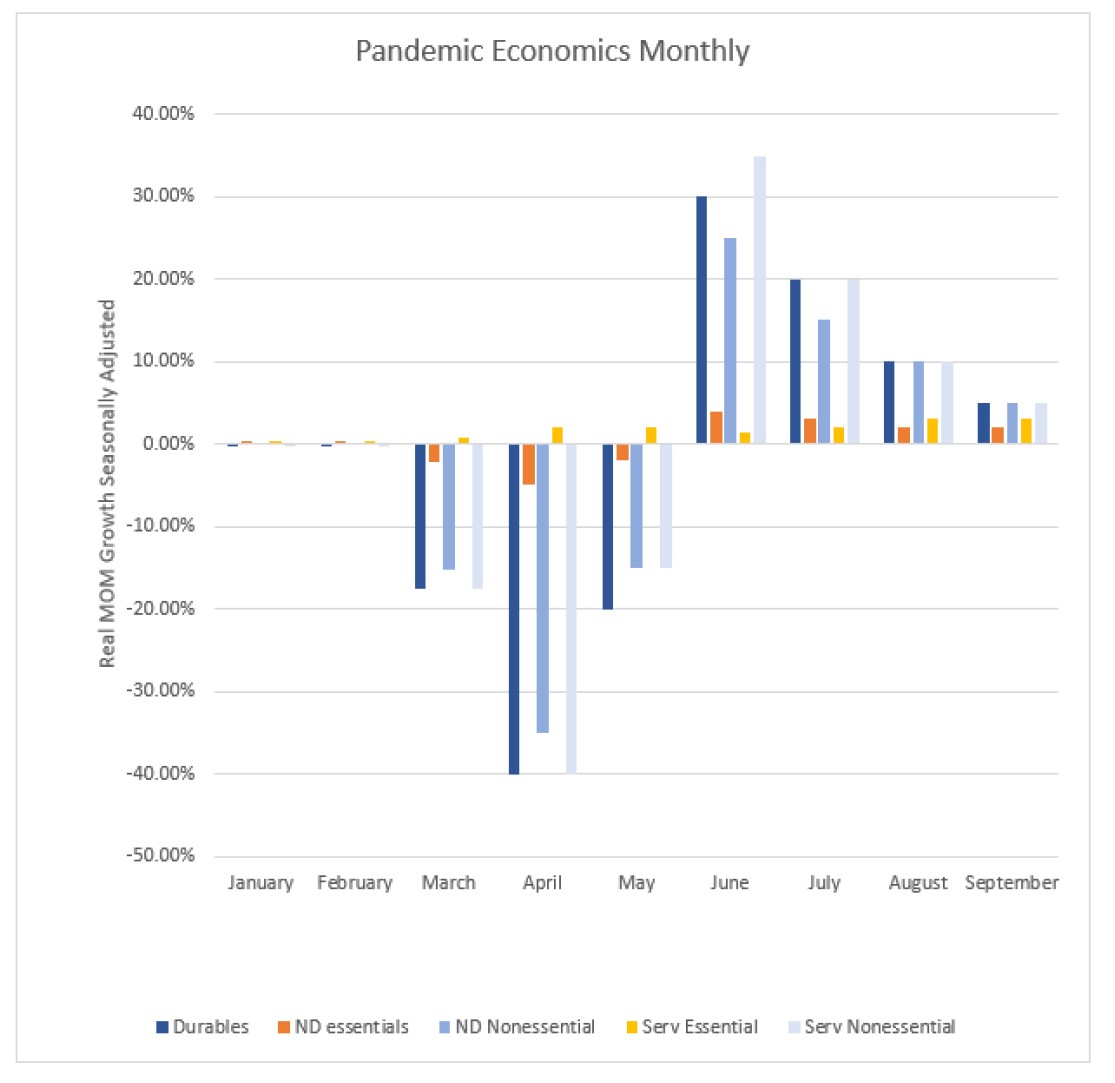

Graph 2 (below) presents a chart from a webinar produced today by Broughton Capital, where we presented a look at the economic effects of the contagion and the resulting economic restrictions. It shows the highly volatile conditions expected for the next three months. April will be down dramatically, the weakest month in U.S. history, to be followed after another very weak month by strongest month in U.S. history, the bounce back in June. This will be a wild ride for supply chain managers and their associates.

I read today that the Pennsylvania Legislature is considering a bill to override some of Governor Wolf’s economic restrictions. This is clear evidence of the growing concern for those economic effects. We will hear more of this in the coming weeks.

We’ll be back Monday with COVID-19 updates and information that came through over the weekend.

Passover, Good Friday, Easter and the end of another week of captivity requires a fun song, so here’s Judy Garland with “On the Atchison, Topeka & the Santa Fe” from the 1946 film Harvey Girls.

Passover, Good Friday, Easter and the end of another week of captivity requires a fun song, so here’s Judy Garland with “On the Atchison, Topeka & the Santa Fe” from the 1946 film Harvey Girls.

My friend Larry Gross not only reports on rail and intermodal but is also an avid photographer. He shares one of his pictures of a Santa Fe steam engine at work.