Market Economics in Tough Times

An In-Depth Look from TIA’s Chief Economist Noël Perry

Truck Rates Are Tumbling. Who’s to Blame?

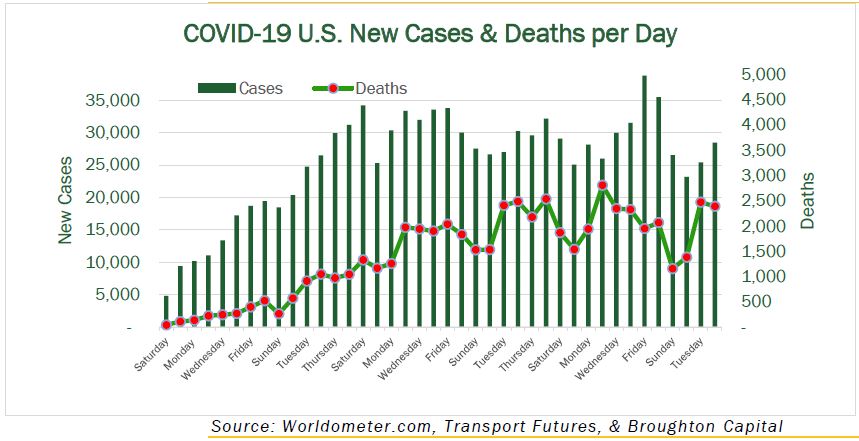

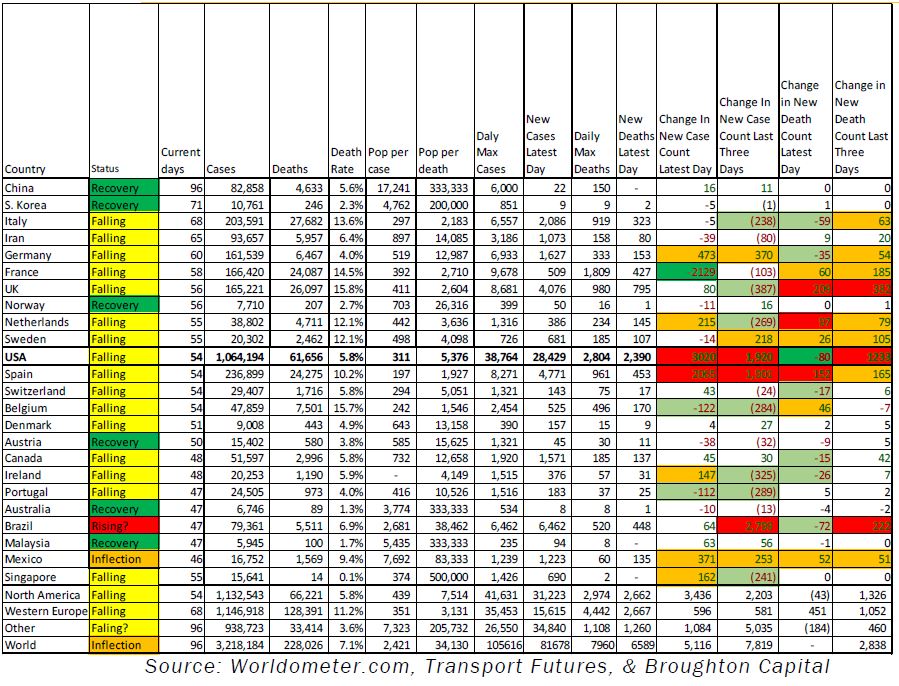

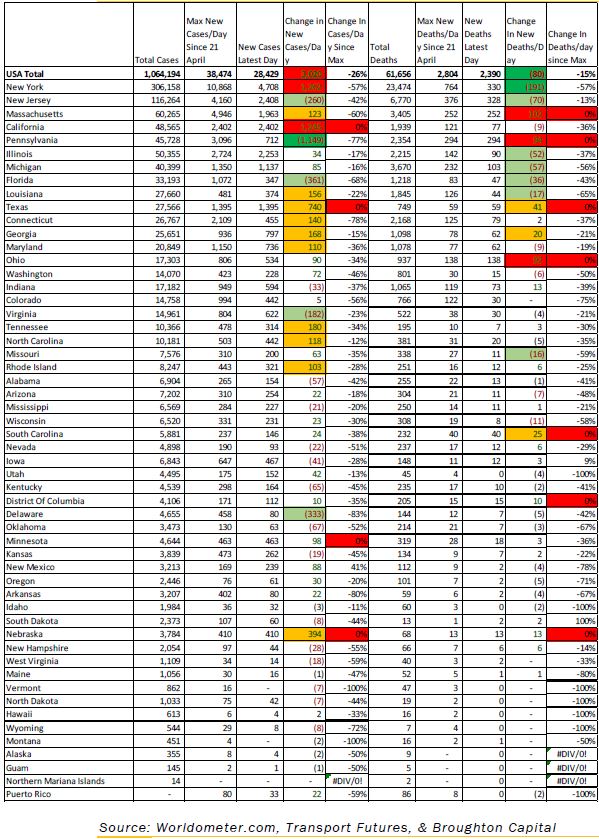

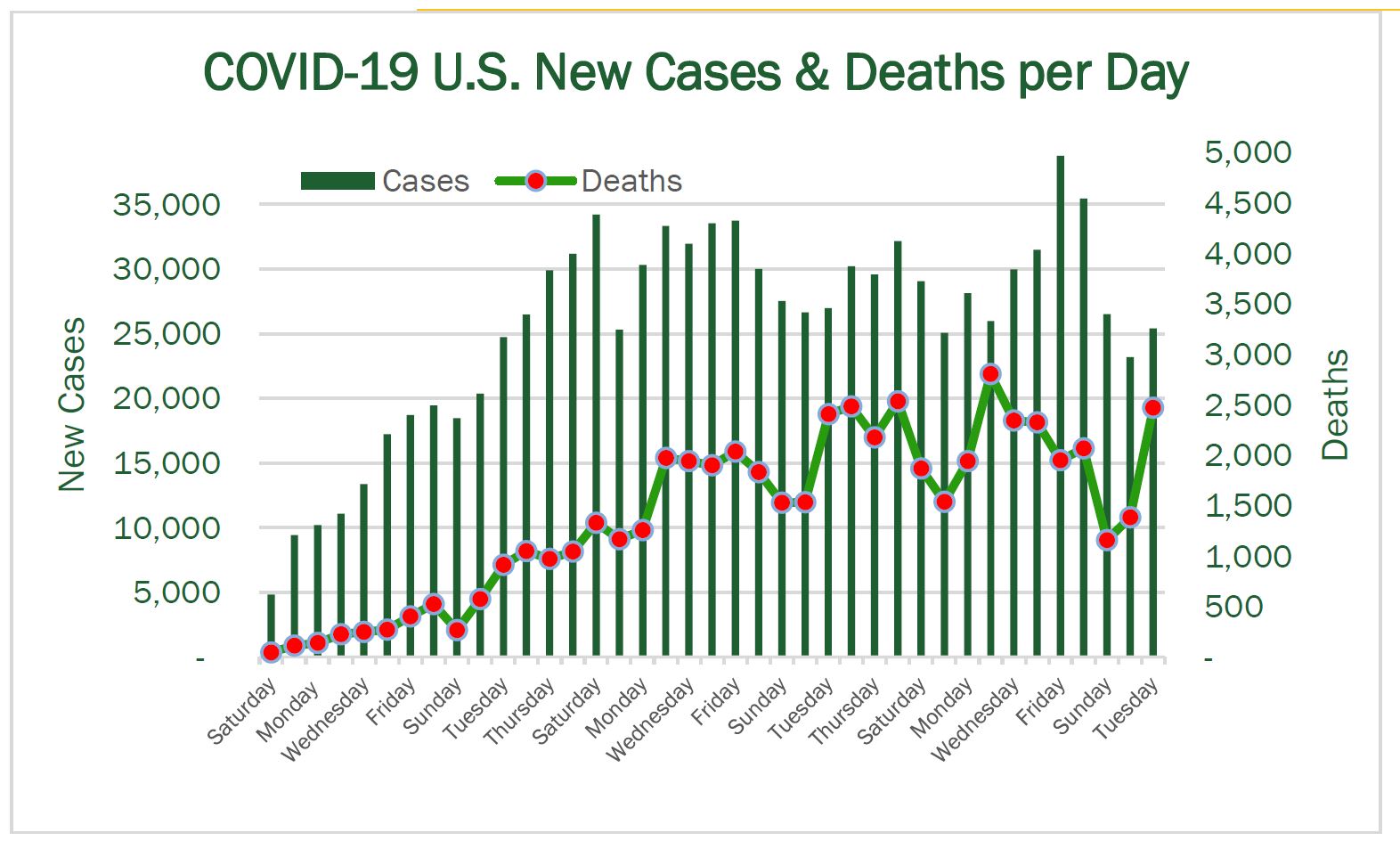

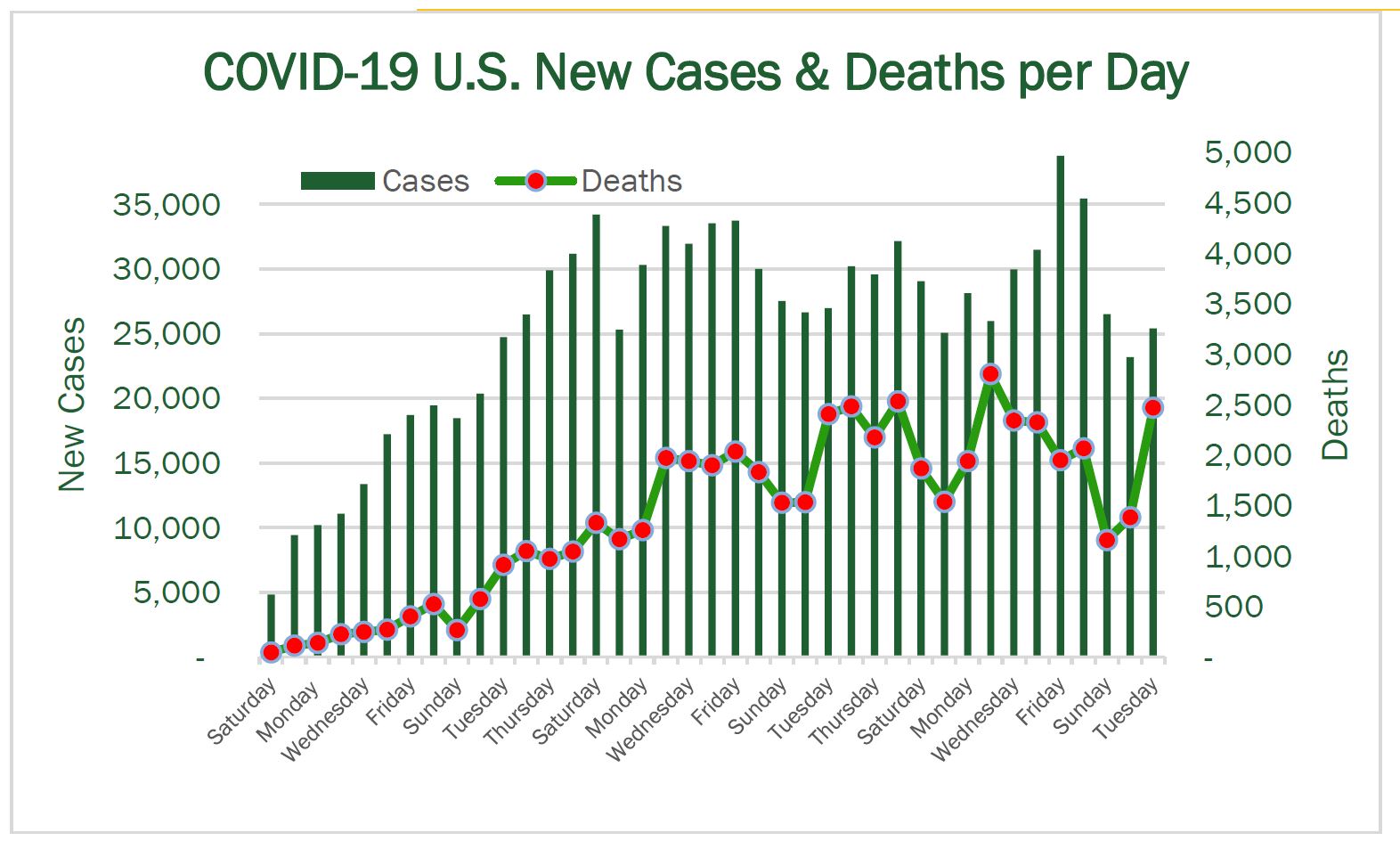

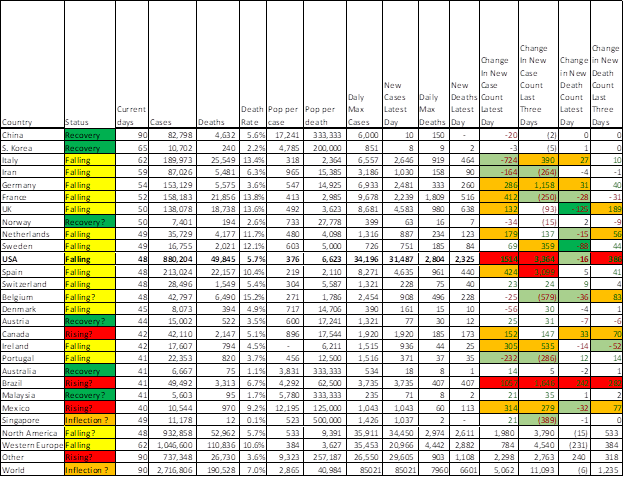

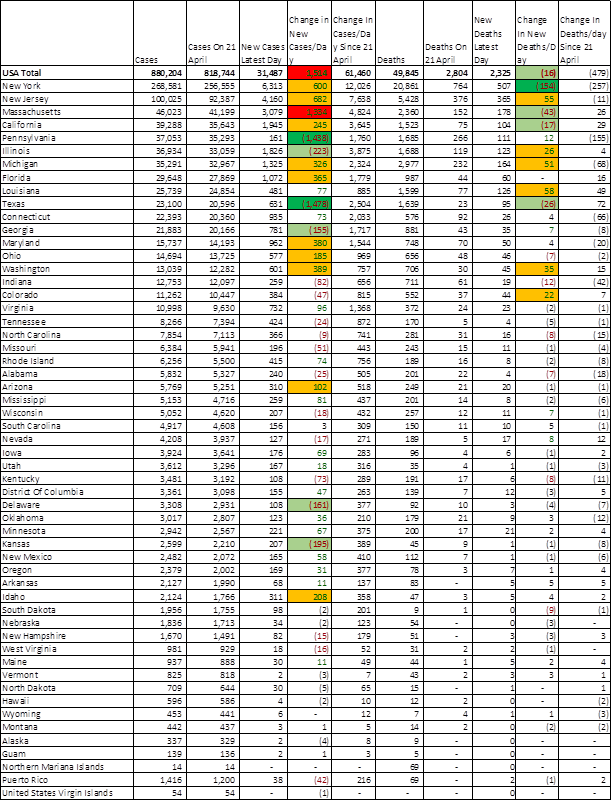

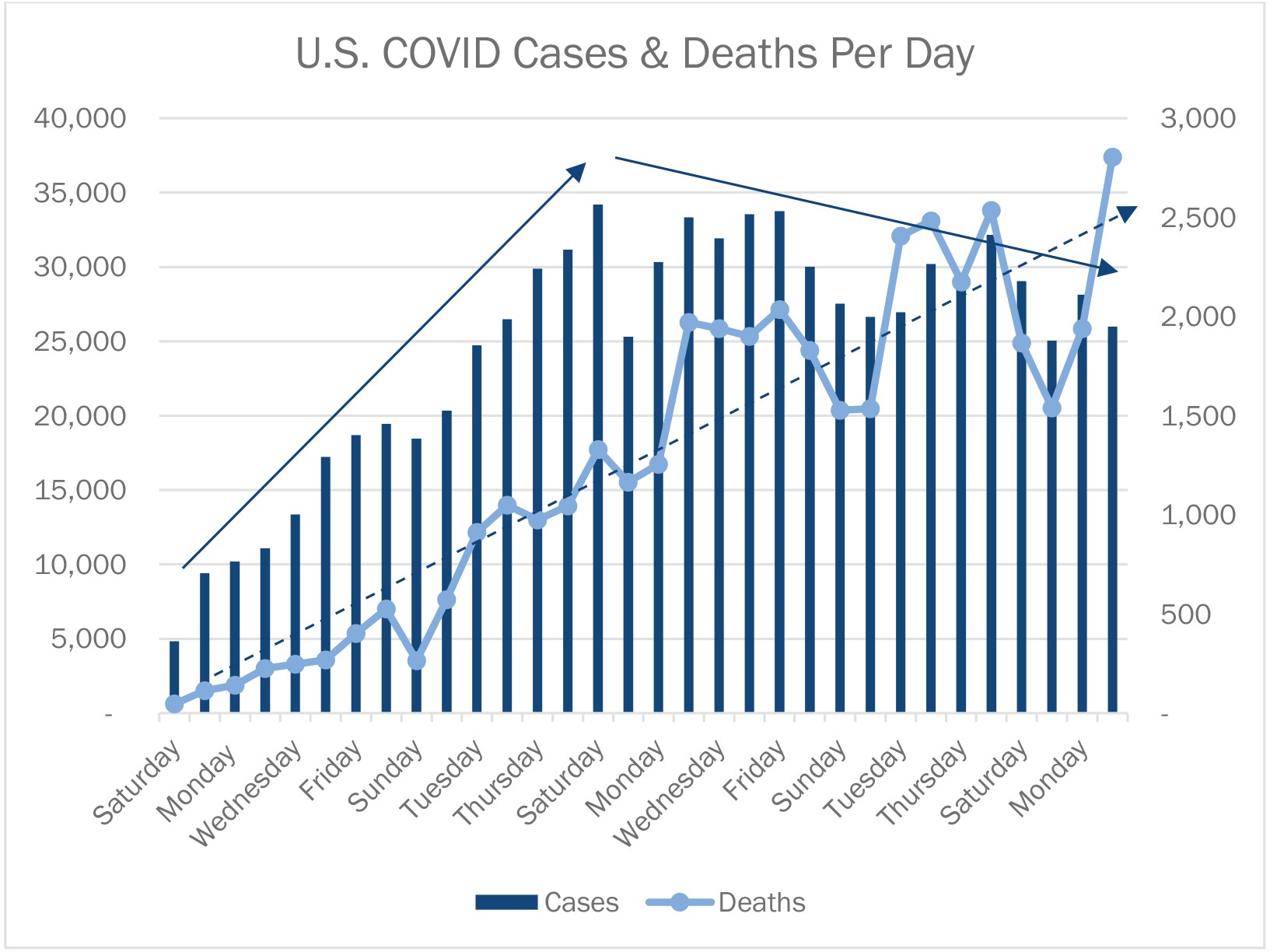

Earlier today, the Federal Government released its initial estimate of 2020:1 economic growth. That was an important event because 2020:1 is the first quarter to contain any of the effects of the economic shutdowns imposed by governments in their attempts to contain the COVID-19 virus.

The value of -4.8% is the worst U.S. quarterly economic performance since the Great Recession, and that negative figure is largely the result of only the last month of the quarter. I estimate that the March number was -13.8%. Unfortunately, that March number will probably be topped in April, and perhaps May. If so, the second quarter will come in at -15% or worse, making it the worst economic quarter in U.S. history.

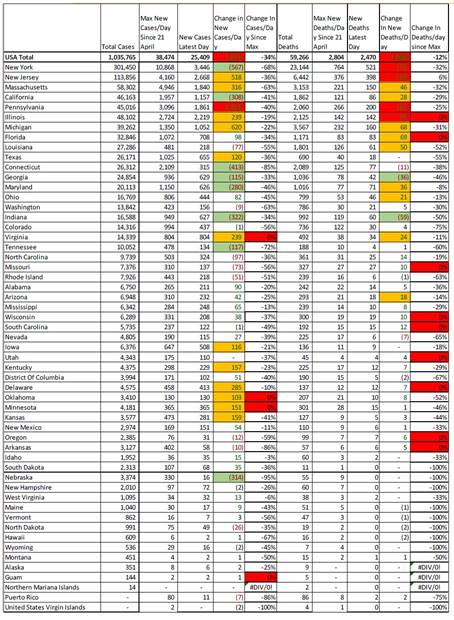

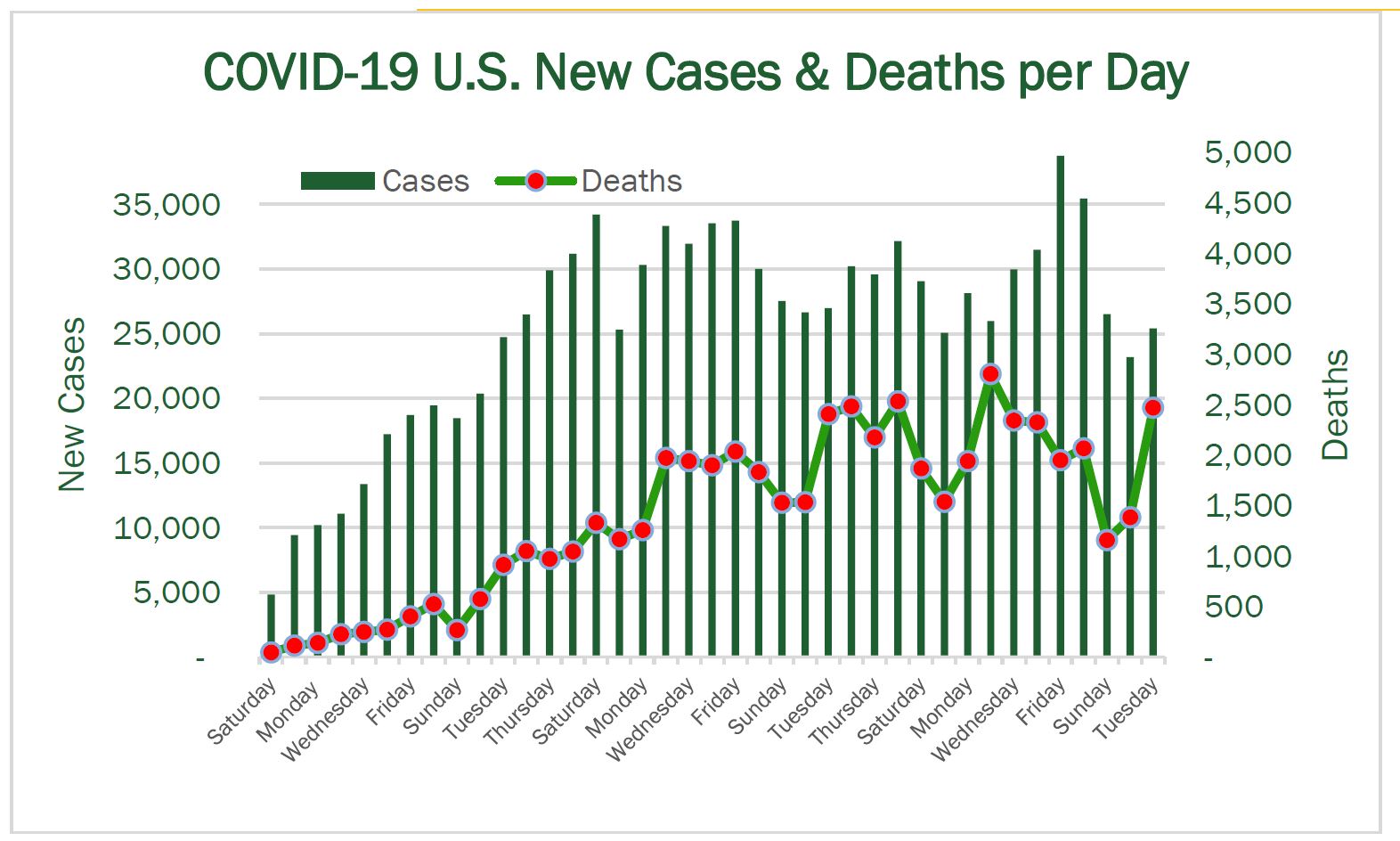

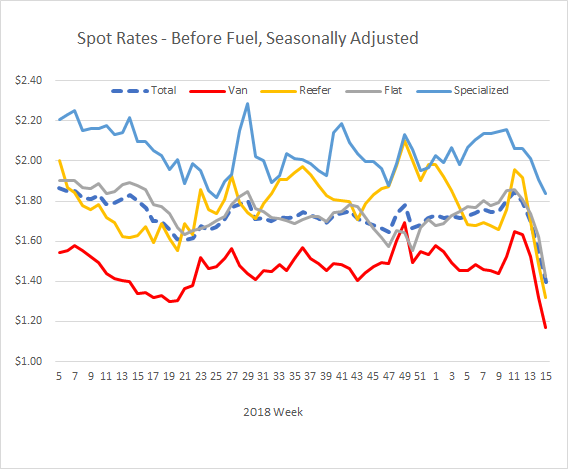

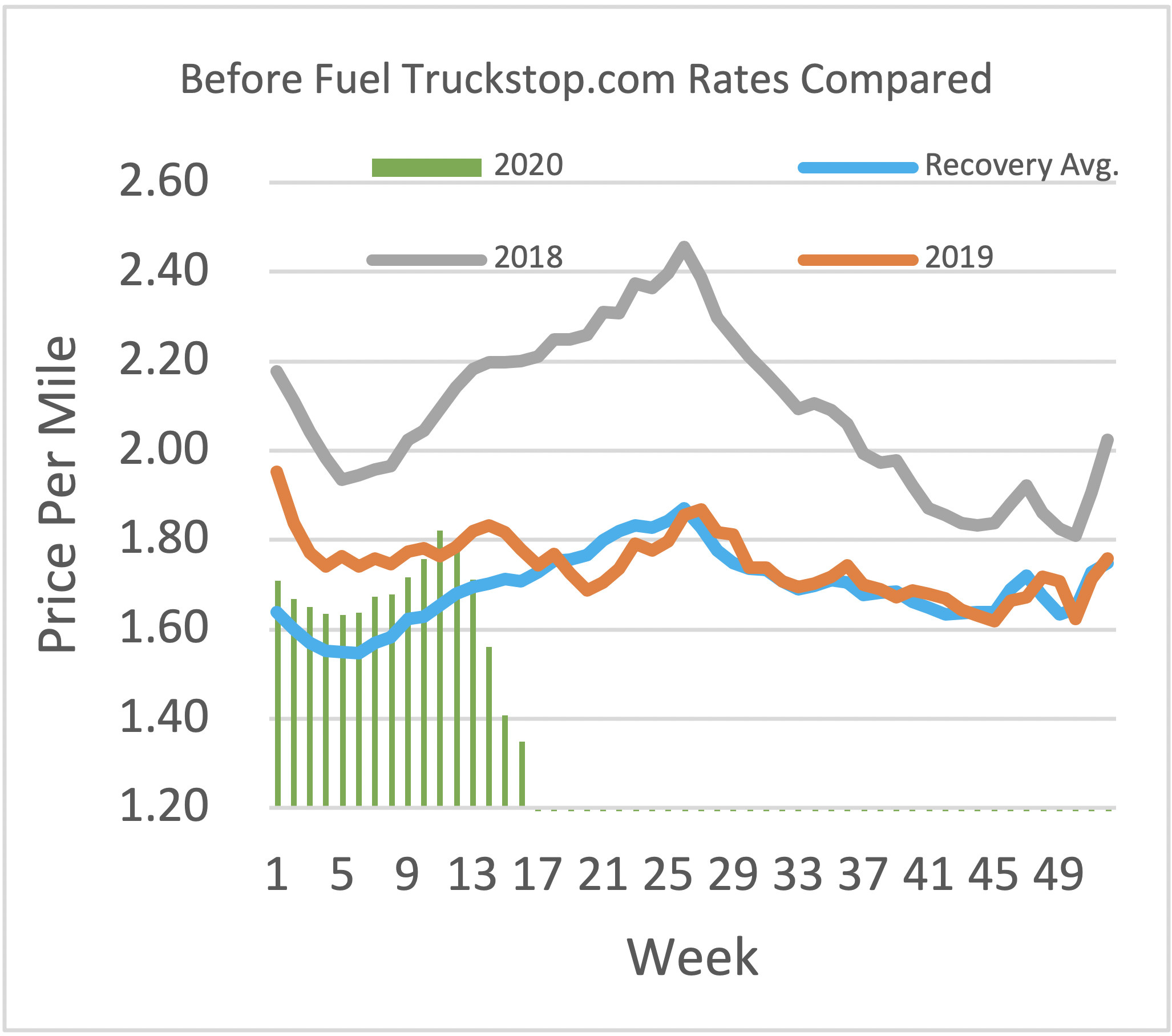

Why is that important? When the economy tanks, so does trucking. When trucking tanks, so do rates. That is what markets do. So, why are rates doing what the Truckstop.com numbers in the accompanying graph shows? It’s the economy stupid; or more specifically, it’s the shutdowns from COVID-19 control measures.

I write this piece, an update of something I wrote last fall, because being human, when something goes bad, we look for a scapegoat. As usual, in trucking, when something goes bad, people frequently point their fingers at my friends in the brokerage space. People are always suspicious of people that “arrange” things rather than “do” things, even if the “arranging” is a necessary part of the doing. After all, a broker’s work is basically work outsourced from shippers and carriers. The work must be done for every trucking transaction.

In around a quarter of cases, people find it more efficient to pay a broker to do that work rather than take the time and money it takes to do it one’s self. Nonetheless, during tough times it is common practice to badmouth the brokers. Somebody must be at fault here, right? Well, somebody may be at fault here, or maybe it is just the virus. But it sure isn’t the brokers. Here’s why:

- What Did Adam Smith Teach Us? The North American brokerage market is as freely open a market as any in the world, regardless of commodity or service. There are no pricing regulations and precious few barriers to entry. If a broker is regularly mistreating carriers (carriers that, in many cases, they have been working with for years), the carriers need simply to shift to another of the 16,000 licensed brokers – all of whom are hungry for business, especially now.

- What Goes Up Eventually Goes Down? People often cite the tendency of broker margins to increase in tough times as evidence of the broker’s greed. Indeed, broker margins do sometimes increase during times of low pricing, but not from greed – but rather from a long-standing and well-known fact of truckload pricing economics. In softening markets, carrier prices usually fall moderately faster than shipper prices, with broker margins rising. Of course, in rising markets, the reverse happens: carriers’ rates rise more rapidly than shippers’ rates and broker margins fall. Using the broker-bashers’ logic, brokers must have been scrimping on their profits to help the carriers in 2017 and the first half of 2018 when rates were rising. My broker friends value their carriers, but not that much!

- Accounting 101: The cycle in broker margins is primarily an accounting issue. Market economics tells us that scarcity or surplus of assets affects the pricing of assets and the cost of services provided by those assets. Intermediaries, like brokers, add a relatively fixed cost to facilitate the match of assets and demand and execute the accompanying transactions. It follows that such a fixed cost will occupy a smaller portion of a total rate, in a tight market with high rates than in a soft market with low rates. The numerator, the broker’s fee, doesn’t change while the denominator, the price of the load, does. The percent represented by the broker’s fixed fee does change. A simple calculation using average rates for the period 2018:2 to 2019:2 shows an increase in broker’s margin of 306 basis points using a fixed absolute value for the broker’s take. That example yields the same internal broker dollar return in both cases: same service, same absolute broker payment, same “profit.” Note importantly that, recently, broker margins have been falling in a falling market, indicating a significant reduction in broker profit. Brokers have been sharing the pain this time around and will continue to do so in these tough times until our governments reopen the economy.

- Volatile Markets Increase the Value of Broker Services: Finally, and perhaps more importantly, brokers exist because they can solve the tough problems of matching spot and other difficult freight to capacity. The regular freight that gets covered by contracts is the easy stuff. Do a deal in January, and the freight moves for a year with no additional transactional work. Not so with the spot market. In volatile times like these, when freight volumes and shipper and carriers’ strategies change radically, the number of tough problems wanting solutions skyrockets. Yes, the price of the move may fall (or rise when the economy recovers), but the difficulty of the work is greater when the market is changing. We need brokers more than ever – right now!

Here’s the Point:

Pointing fingers during a time of stress has little value. Carriers, and shippers, would be best served by focusing on the best ways to get their loads moved and trucks full. For at least a quarter of freight, that process benefits from, or more powerfully, “needs” brokers. Brokers exist and have a growing share of the market because they provide a useful service to shippers and carriers.

Those services retain their value throughout the business cycle, even if carriers are happy at the top and unhappy at the bottom, and shippers are unhappy at the top and happy at the bottom. The notion that an entire group of market participants is operating to the market’s detriment is a preposterous claim that provides no insight to carriers, shippers, or any rational actor in this market.

###

The Transportation Intermediaries Association (TIA) is the professional organization of the $214 billion third-party logistics industry. TIA is the only organization exclusively representing transportation intermediaries of all disciplines, doing business in domestic and international commerce. TIA is the voice of the 3PL industry to shippers, carriers, government officials, and international organizations. TIA is the United States member of the International Federation of Freight Forwarder Associations, FIATA.