As TIA continues to monitor the situation surrounding COVID-19 and it’s impact on the 3PL and transportation industries, here is your Daily Update for May 1. As a reminder, you can find all the latest information, resources, guidance, and news from TIA’s COVID-19 Response Center.

FEDERAL UPDATE:

As the U.S. Department of Labor continues its efforts to support American workers and position the economy for a strong rebound, the Department is hosting a national online dialogue on “Opening America’s Workplaces Again,” to solicit ideas from the public on how best to help employers and workers reopen America’s workplaces safely. The dialogue will run from Thursday, April 30 through Thursday, May 7, 2020, and will include a one-hour Twitter chat on Friday, May 1, 2020, at 2:00 p.m. EDT.

As the Department continues to develop guidance and information to assist workers and employers, it seeks to draw on the public’s ideas about challenges that may be faced as businesses re-open. Thousands of workers and employers have been in communication with the department since the start of the crisis, and this dialogue provides an opportunity for even more voices to contribute to the department’s ongoing response as circumstances on the ground continue to change.

Ideas and feedback collected during the dialogue will be used by the Department as it continues to develop compliance assistance materials and guidance for workers and employers, and will be shared with policy-makers at the federal, state and local level as they develop and refine plans on reopening America’s workplaces.

The department’s Office of Compliance Initiatives (OCI) will host the dialogue in partnership with OSHA, WHD, the department’s Office of Federal Contract Compliance Programs, its Employee Benefits Security Administration, its Employment and Training Administration, its Office of Disability Employment Policy, its Veterans’ Employment and Training Service and its Women’s Bureau. Please register to participate at https://OpeningWorkplaces.ideascale.com.

TIA’s Operations Committee is also preparing a document that will provide some guidance for our Members to consider when their workforces return to the office.

VIRTUAL LUNCH & LEARN UPDATE:

Mark your calendars now and plan on joining TIA next week for two great Virtual Lunch & Learn webinars: Financial Strategies for Challenging Market Conditions on Tuesday, analyzing how shippers have responded to coronavirus and what brokers can do to prepare for the next 3-6 months (sponsored by TriumphPay); and Business as Usual on Thursday, featuring nationally recognized Sales Productivity Expert John Boyens (sponsored by Teknowlogi).

NOËL PERRY UPDATE:

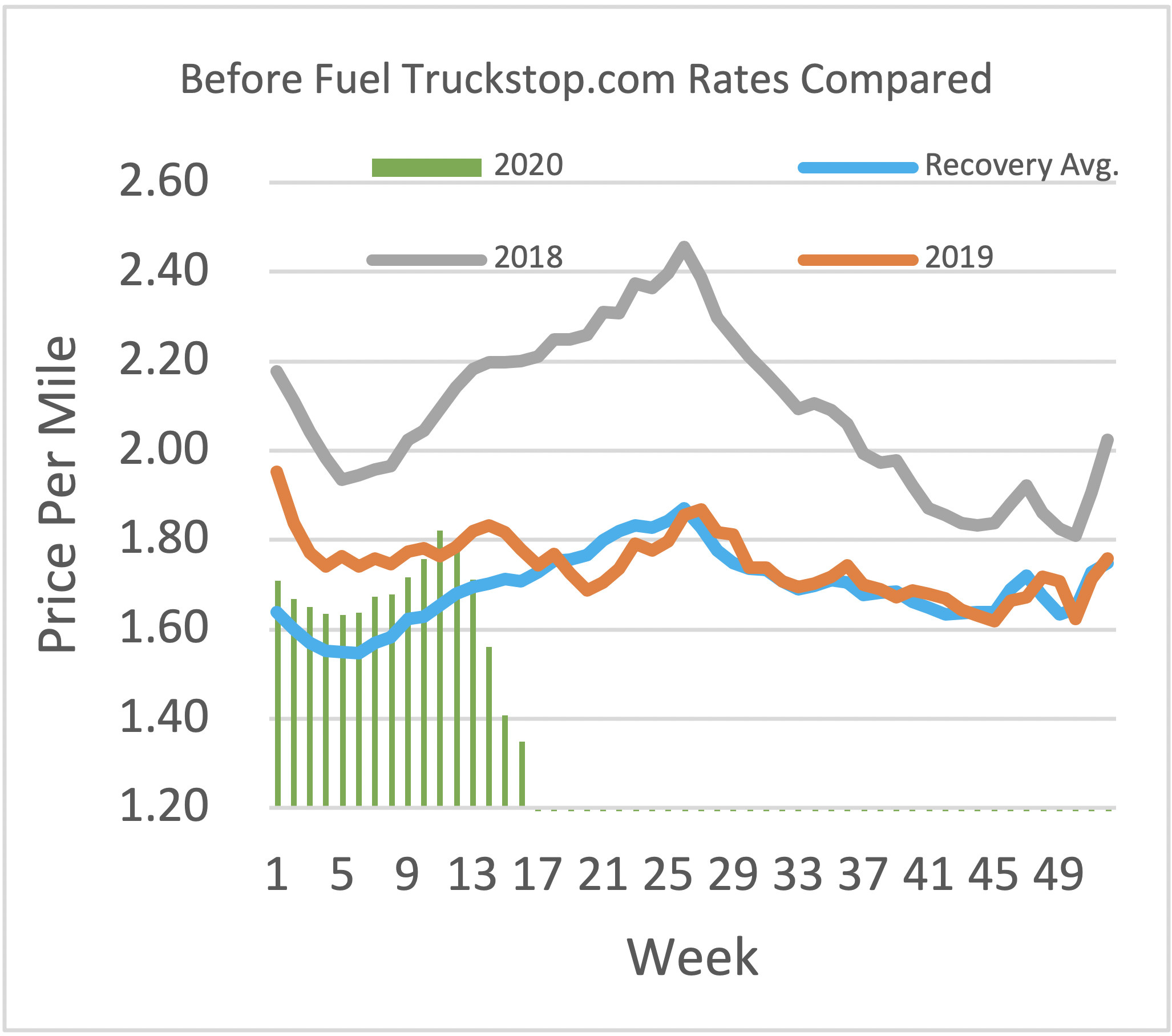

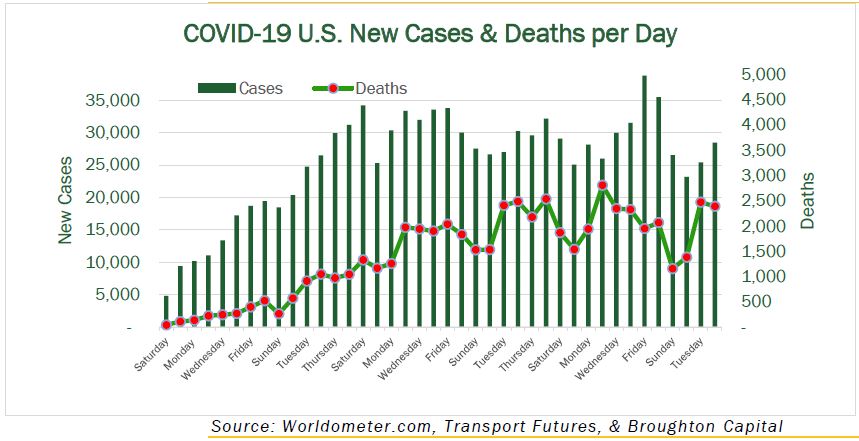

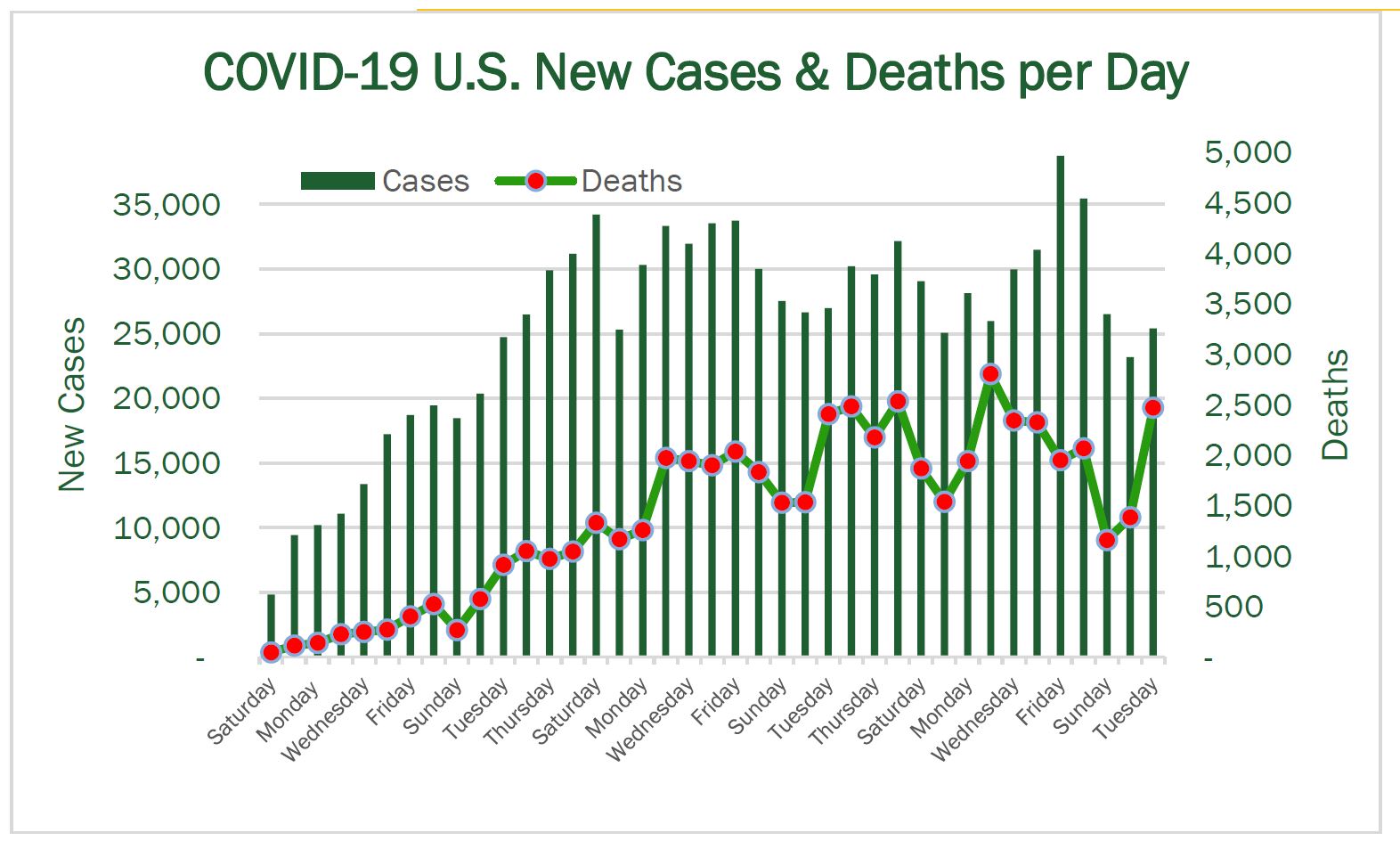

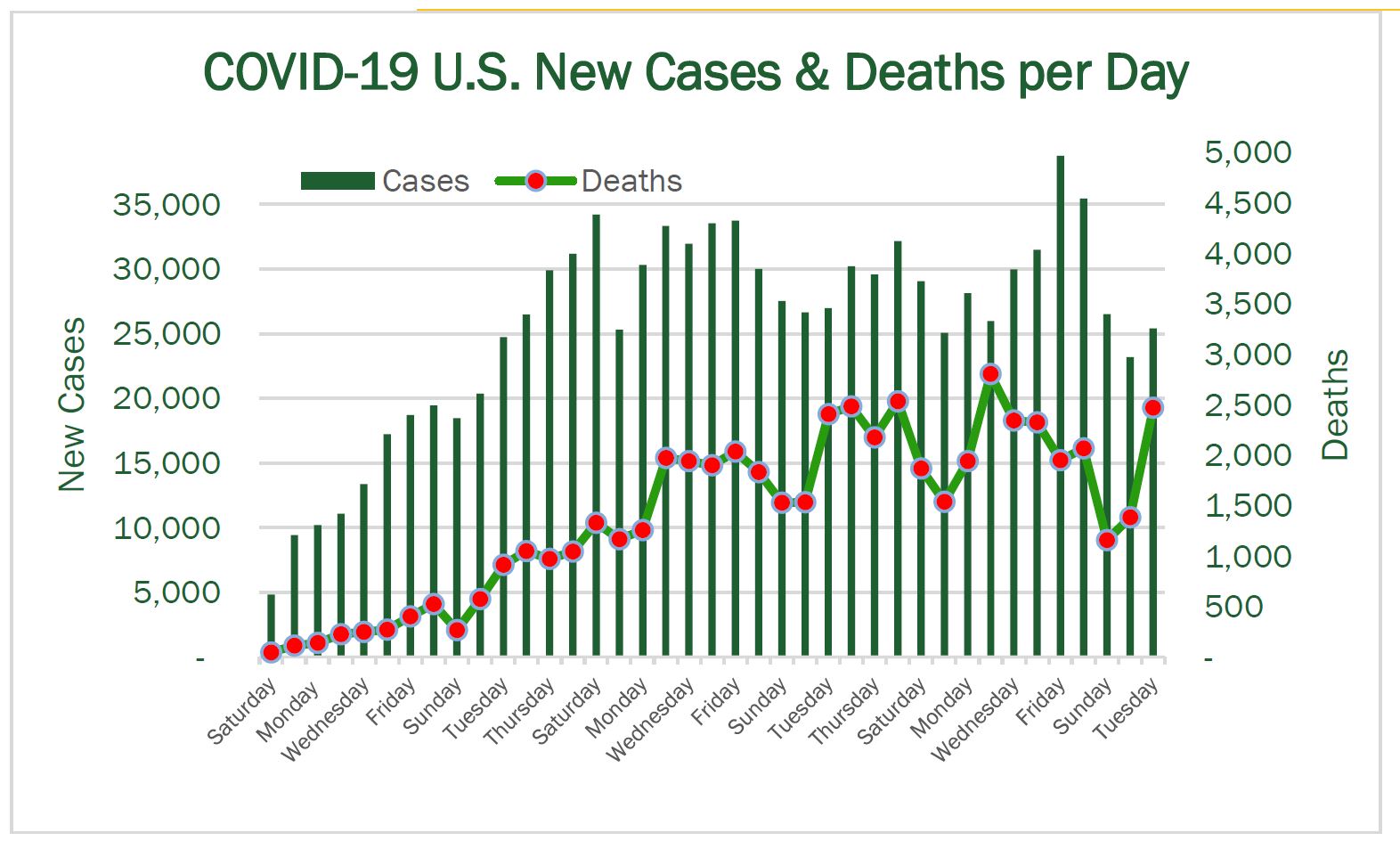

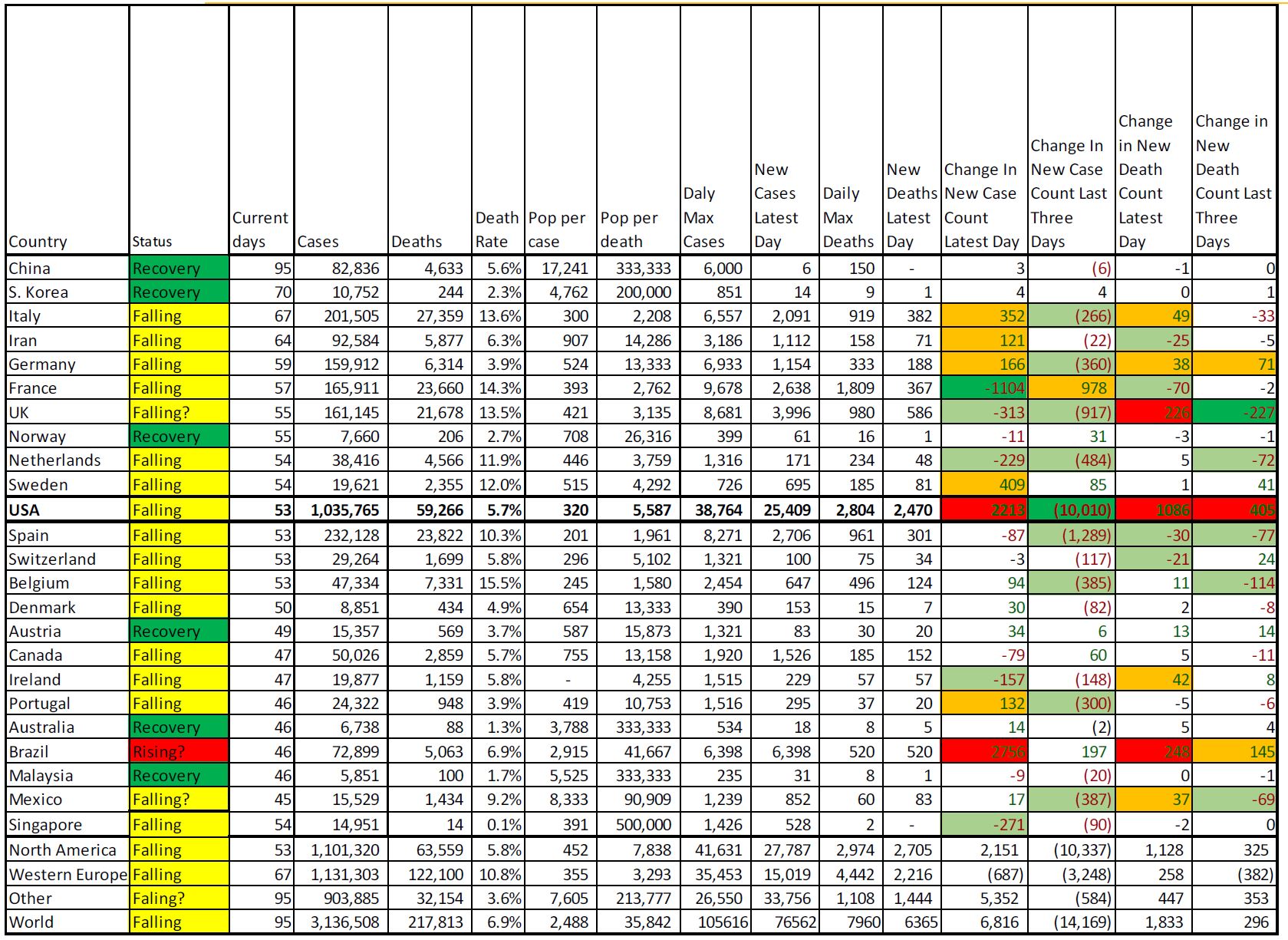

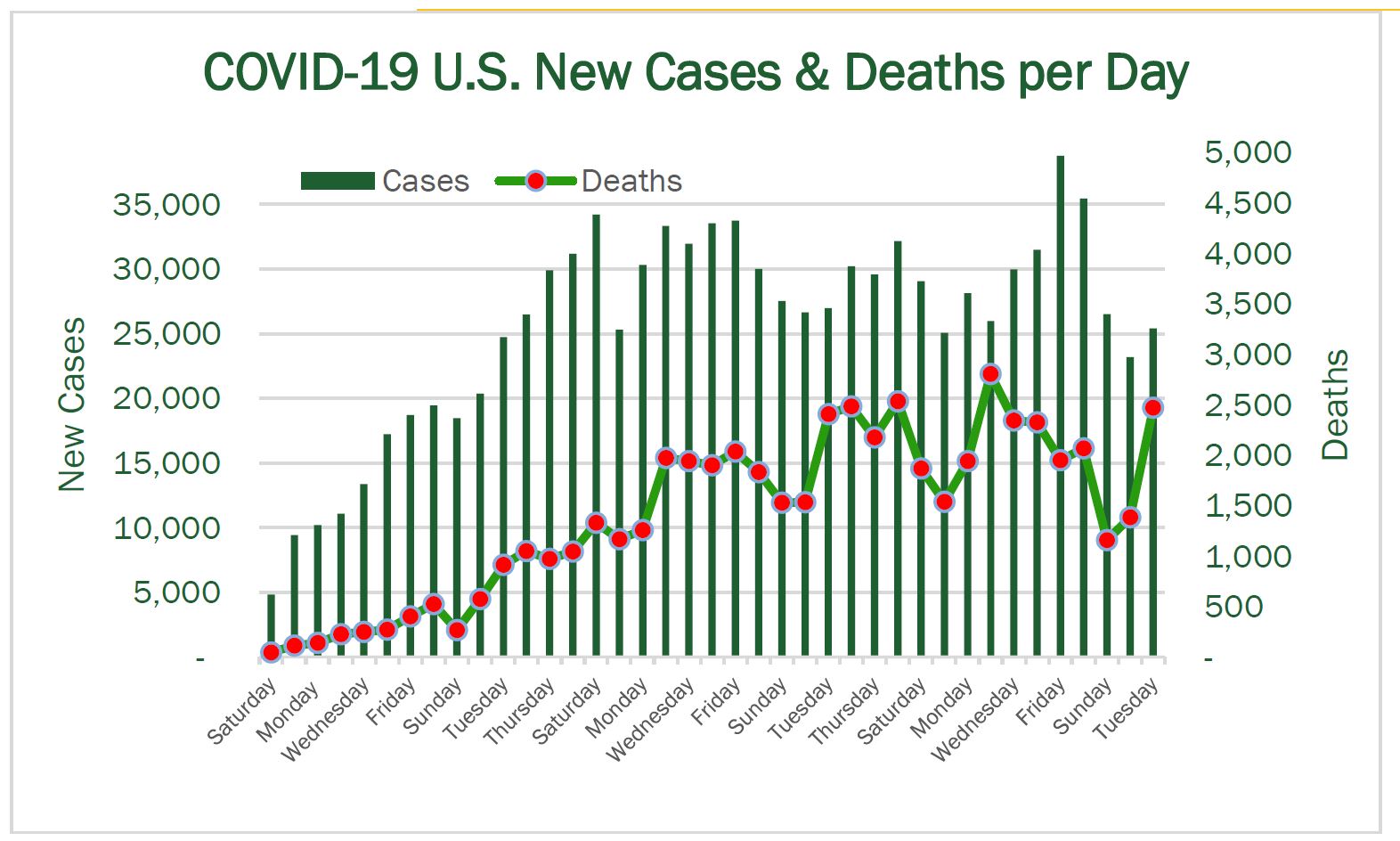

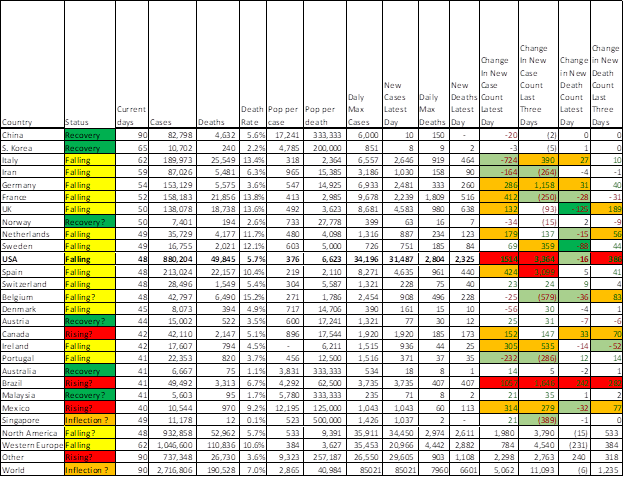

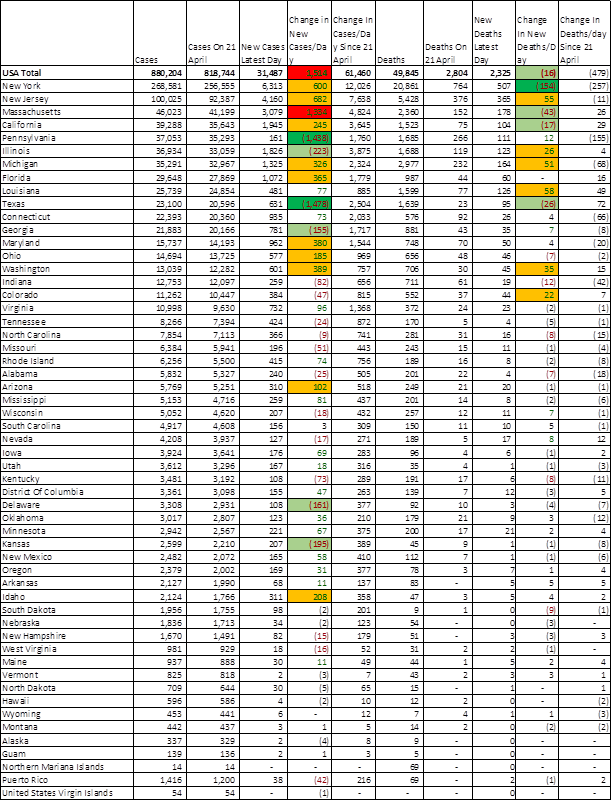

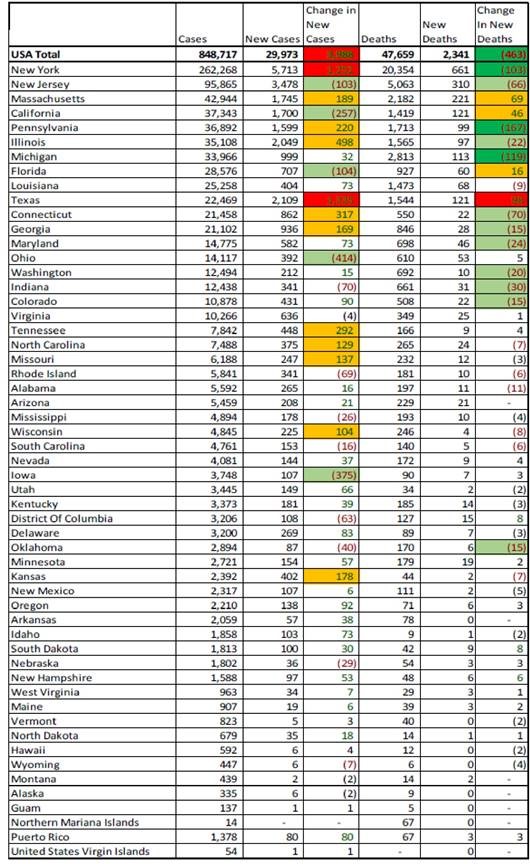

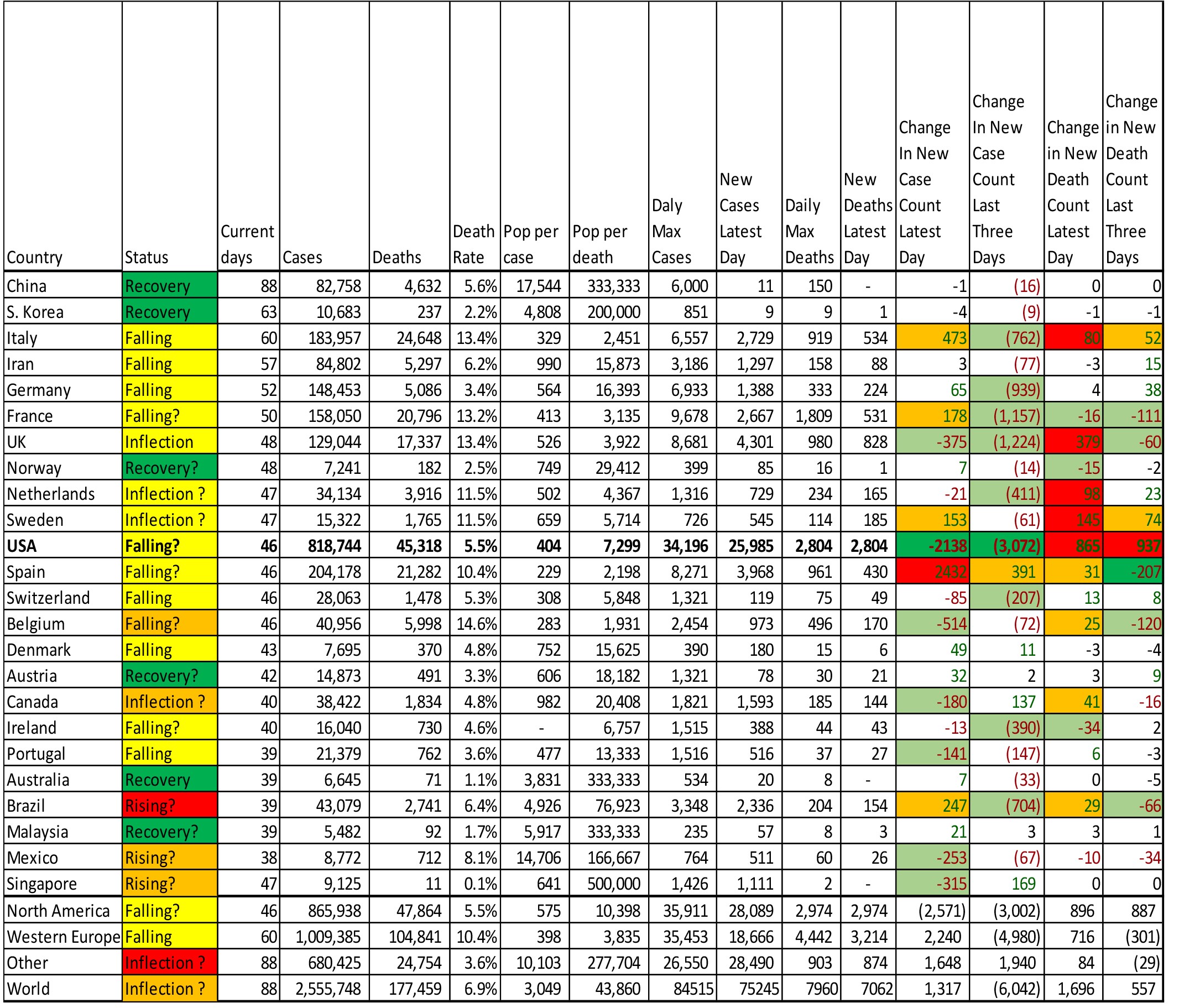

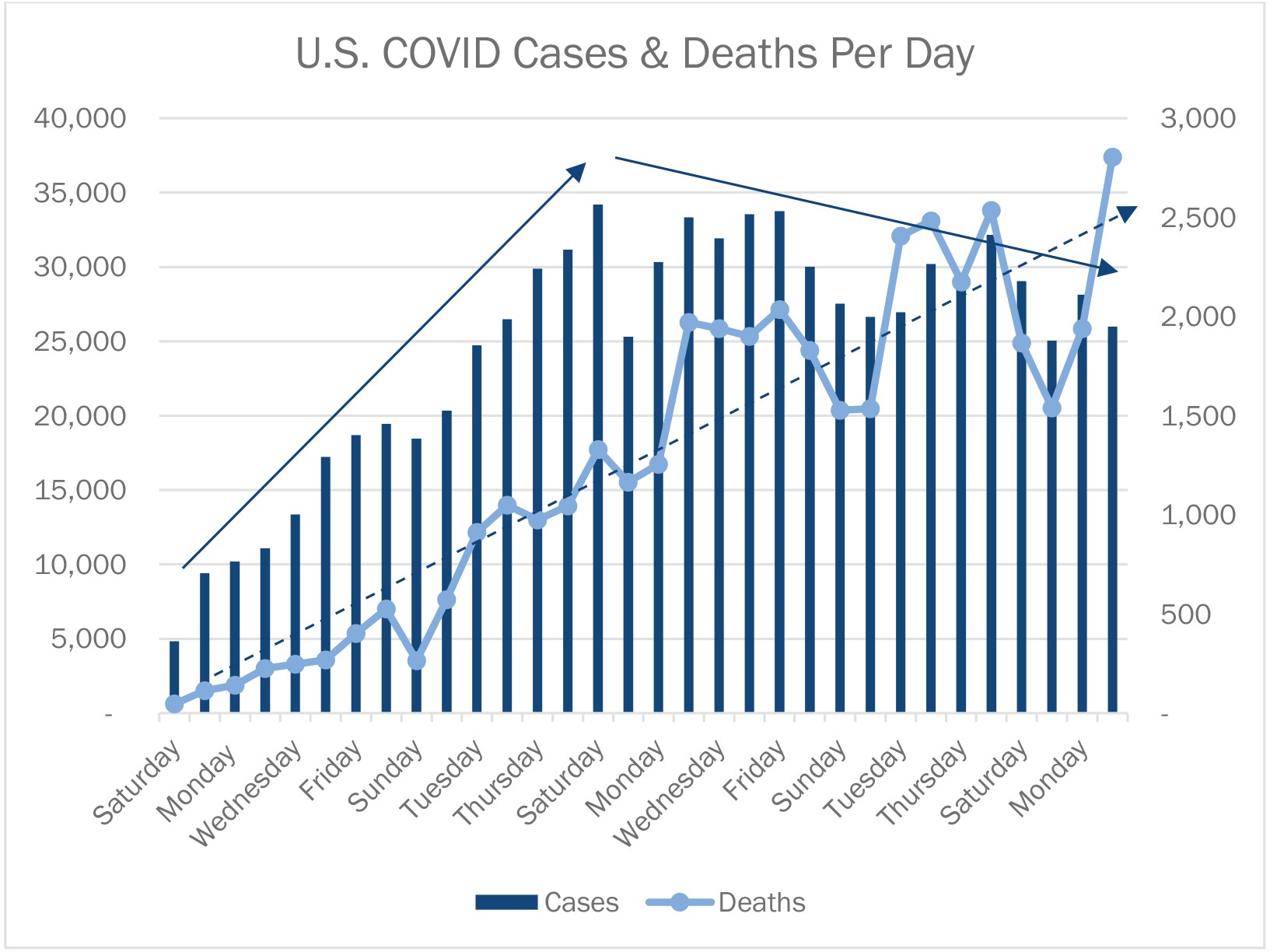

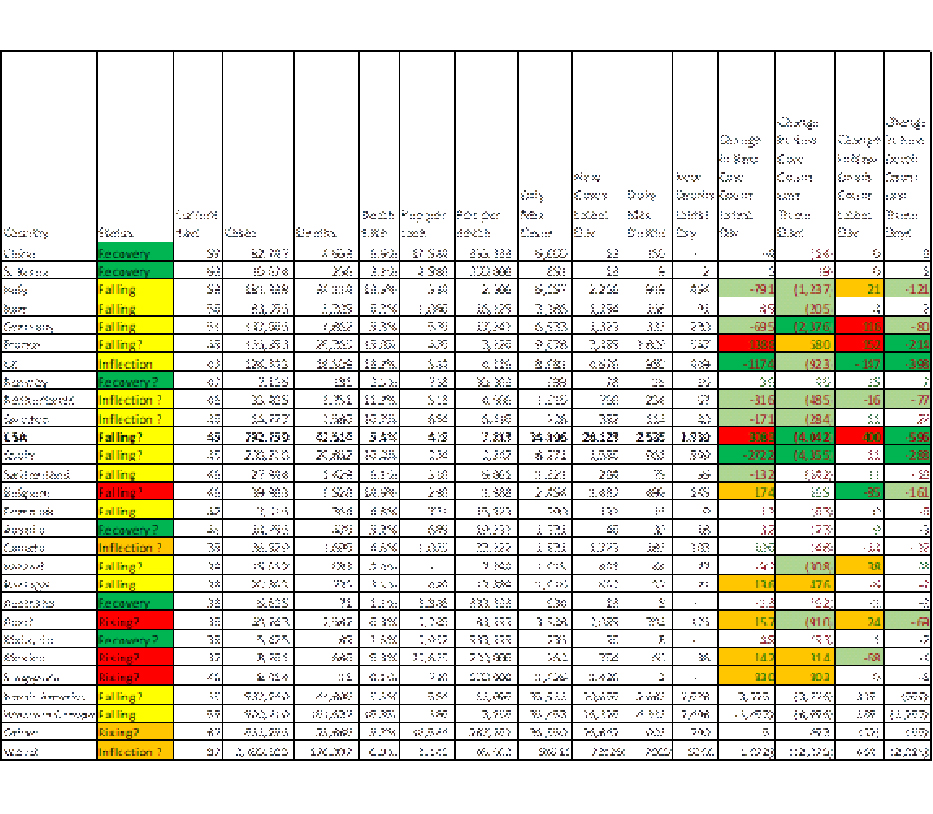

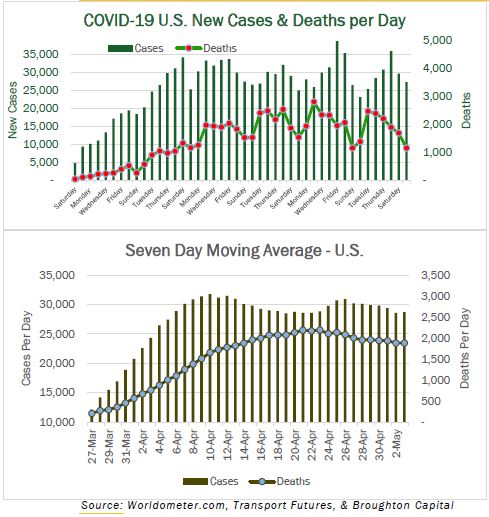

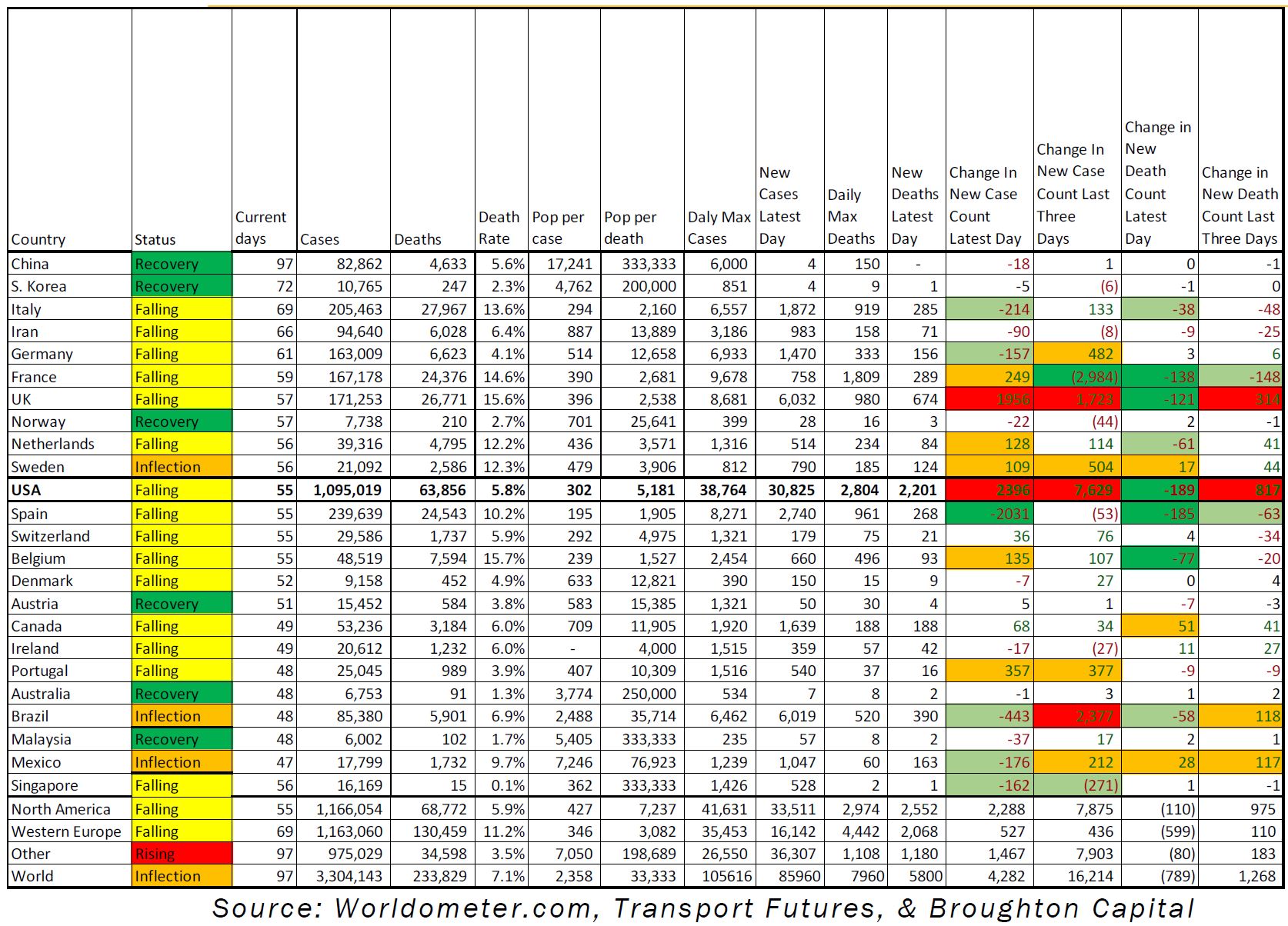

Cases are up for the U.S. and deaths down, although both remain slightly below the numbers from a week ago. Tomorrow will tell us if we are to go significantly below last week. Last week was favorable that way. Let’s hope this week is too.

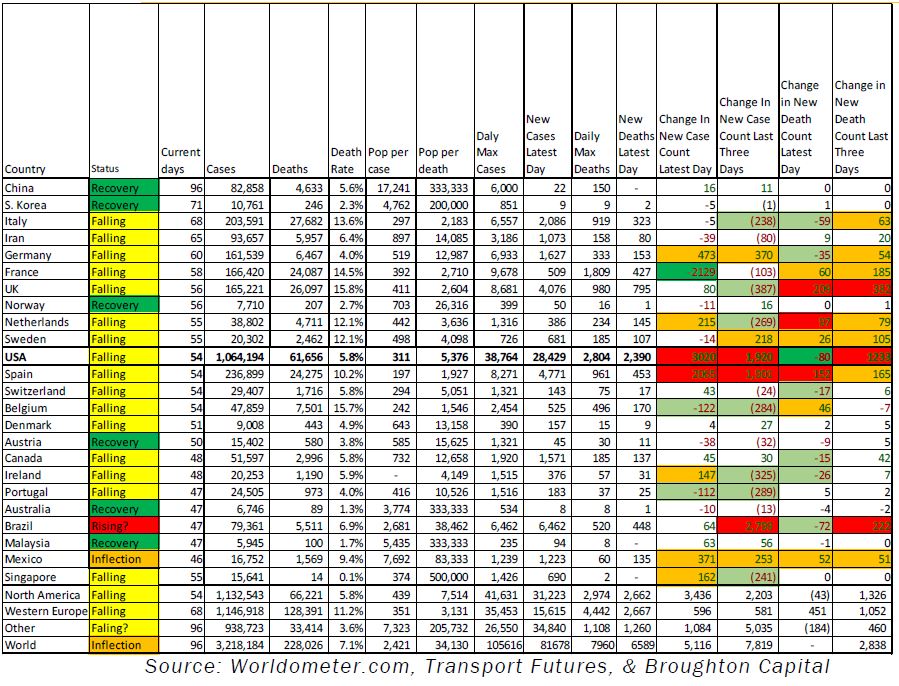

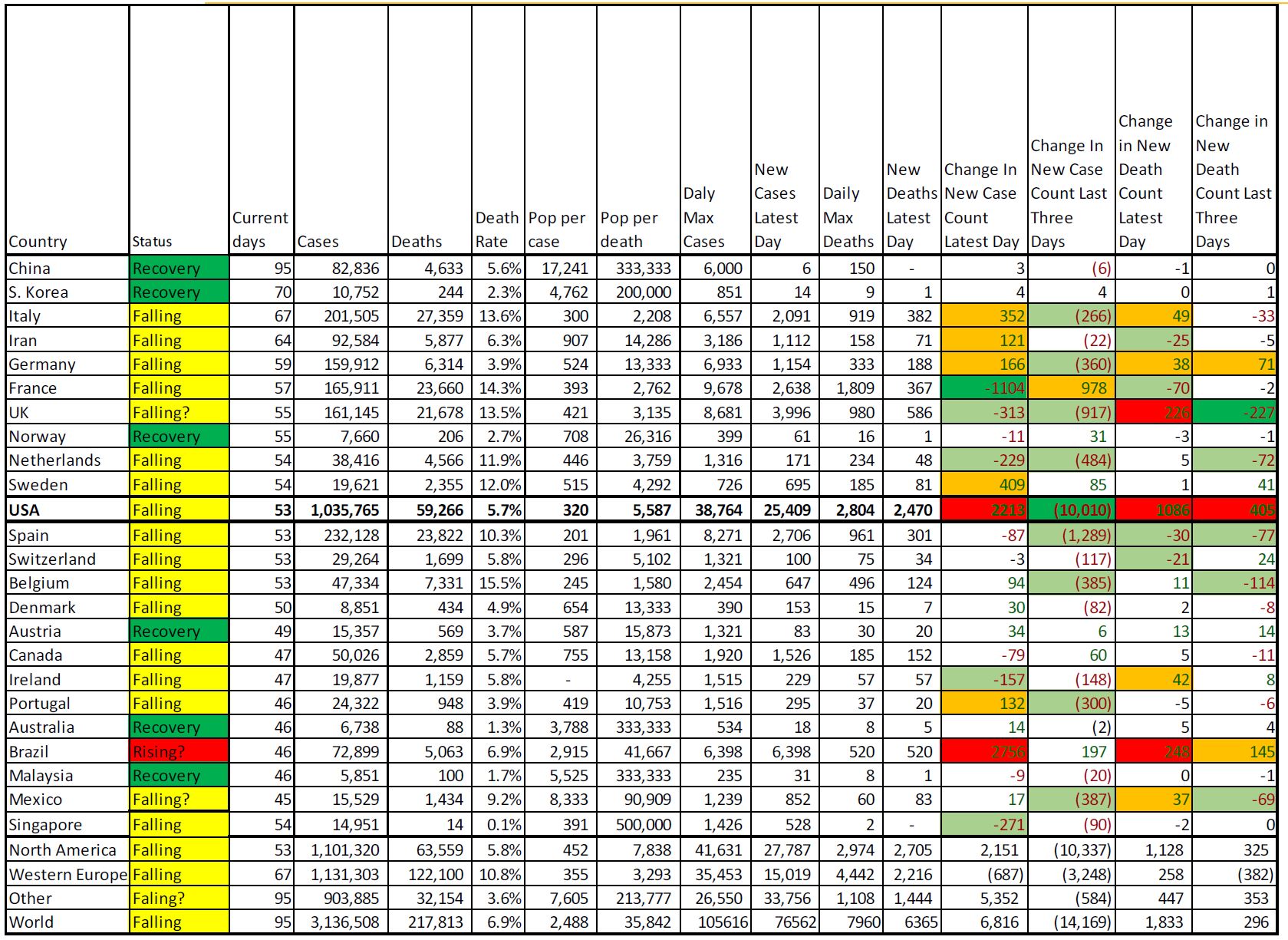

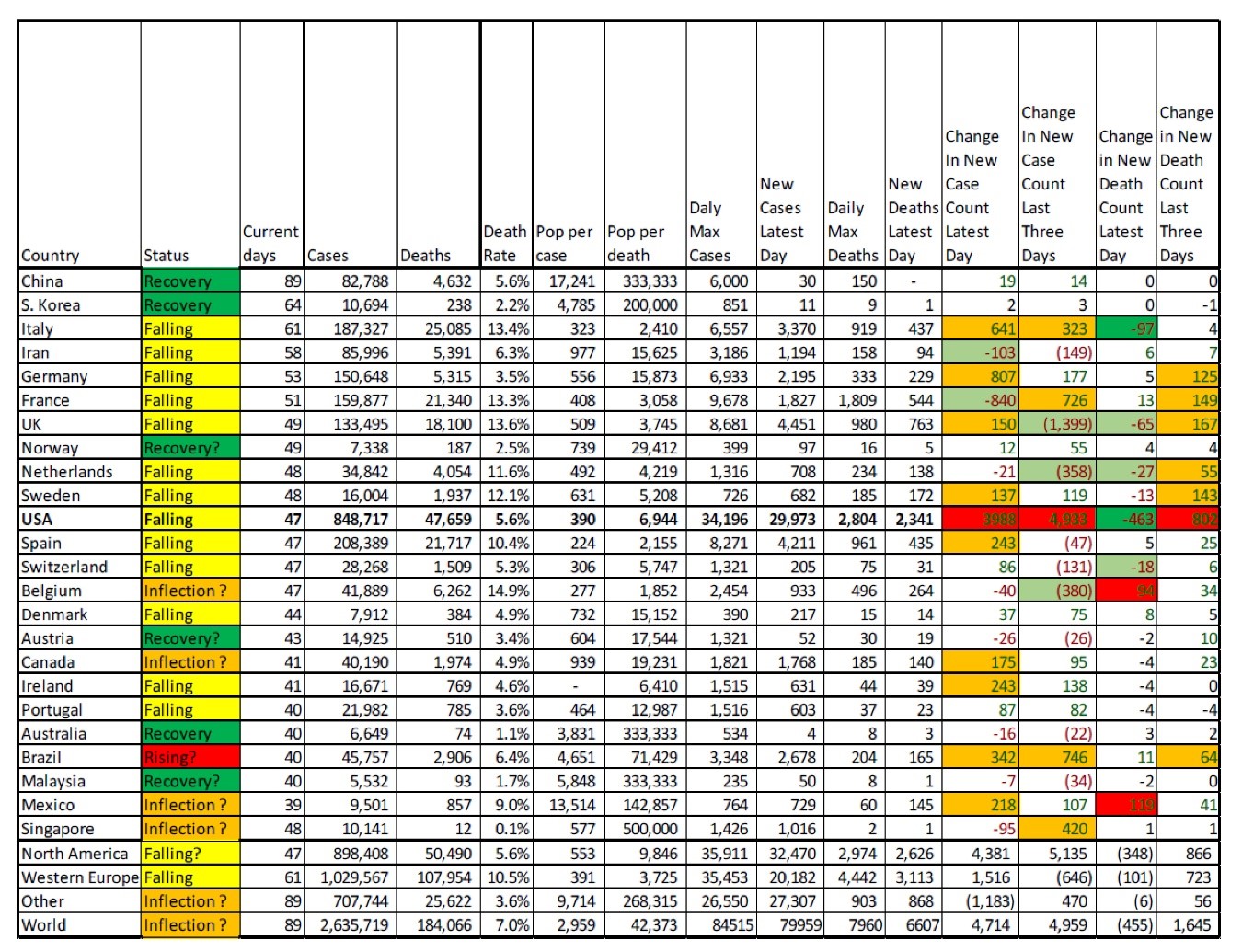

The data continue to show large differences between seemingly similar countries. The U.S. and U.K. remain stubbornly high even as most other countries are on clear downslopes. Note that Sweden is also slow to respond. Its critics cite its lax social distancing rules. Although its experience is clearly worse than some of its near neighbors, its deaths per population remain well below that of its Italy, France, and Spain.

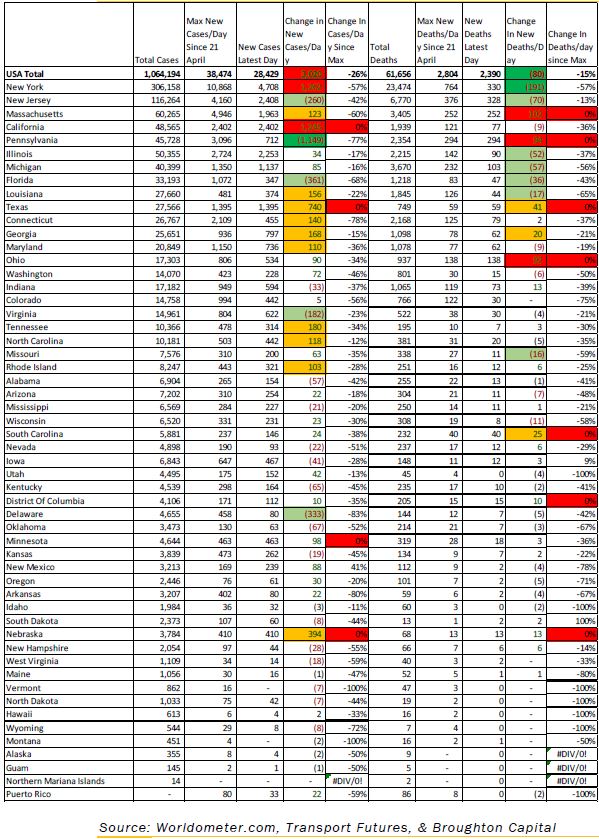

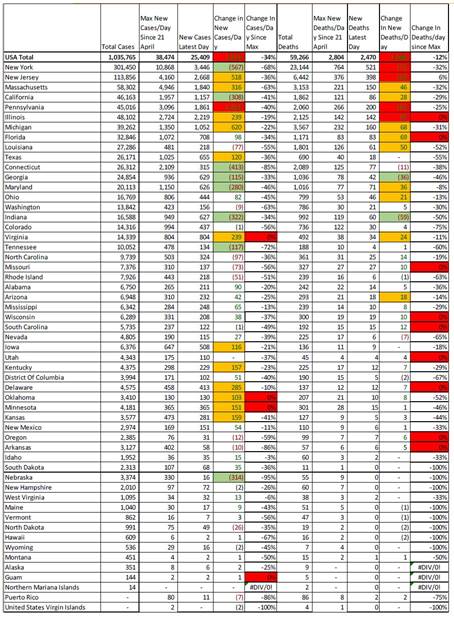

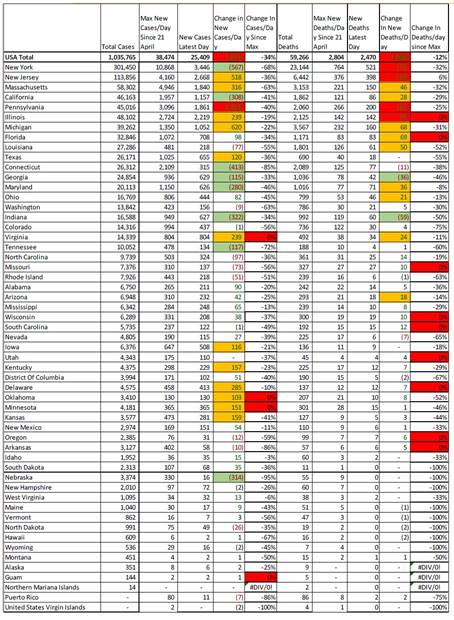

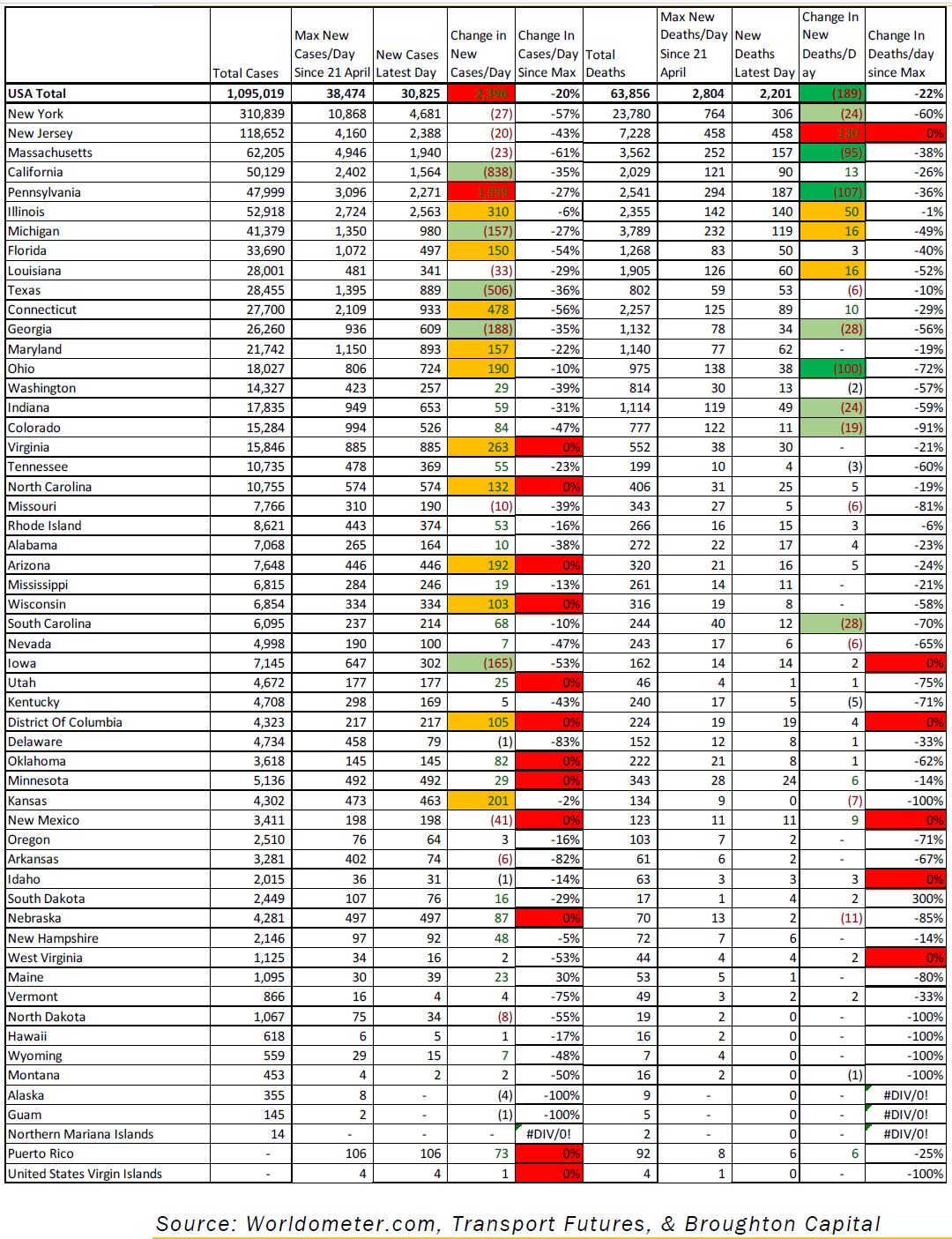

The U.S. state data was highlighted by a bad death count in New Jersey. New York also registered an increase in cases, although it remains 57% below its max since April 21. Note also the rash of new case high among mid-sized states.

We’ll be back on Monday with COVID-19 updates and information that came through over the weekend.

Not sure how the weather was in your neck of the woods this week but with sunshine and warm temps after a couple miserable rainy days in DC, enjoy the sounds of Spike Jones & His City Slickers’ “Cocktails for Two.” (or just enjoy two cocktails)!